As a hotel marketer who’s spent countless nights analyzing spreadsheets and questioning whether RevPAR was telling the full story, I’ve learned that relying on traditional metrics alone is like driving with one eye closed. Sure, you’ll get somewhere, but you’re missing half the picture.

The harsh reality? While 87% of hoteliers still use RevPAR as their primary performance indicator, the most successful properties I’ve worked with track at least five additional metrics that reveal what RevPAR simply cannot. Today, I’m sharing the advanced KPIs that separate thriving hotels from those merely surviving.

Why RevPAR Isn’t Enough Anymore

Don’t get me wrong—RevPAR (Revenue Per Available Room) isn’t obsolete. It’s still valuable for understanding basic room revenue performance. But here’s what RevPAR doesn’t tell you:

- How profitable your actual operations are after expenses

- Whether you’re maximizing revenue from existing guests

- If your pricing strategy aligns with guest behavior

- How your ancillary services are performing

- Whether your marketing spend is generating real returns

I once consulted for a 120-room property in Crete that boasted impressive RevPAR numbers but was bleeding money. Their RevPAR had increased 15% year-over-year, yet their profit margins were shrinking. The problem? They were focusing on the wrong metrics entirely.

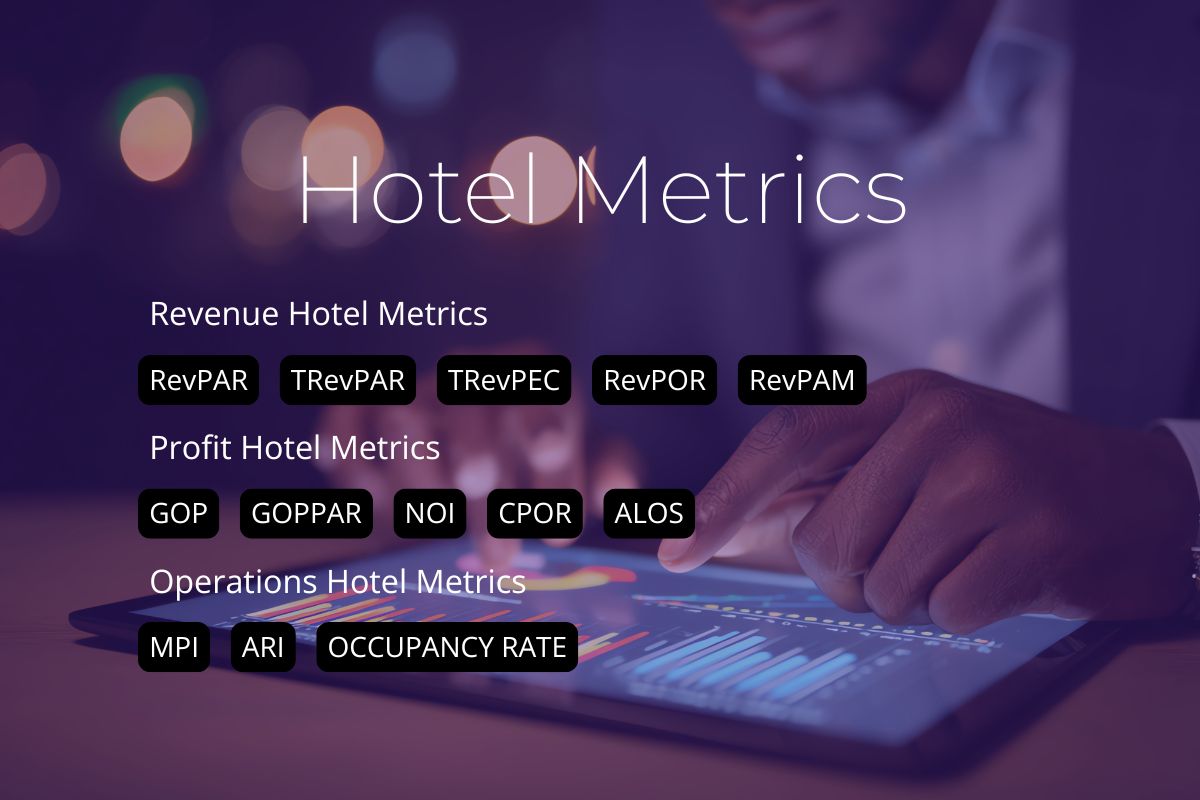

The Essential Revenue Metrics Beyond RevPAR

- GOPPAR (Gross Operating Profit Per Available Room)

What it measures: Your actual profitability per room, accounting for operational expenses.

Why it matters: GOPPAR reveals whether your revenue increases translate to actual profit. A property might have stellar RevPAR but poor GOPPAR due to high operational costs.

How to calculate: GOPPAR = (Total Revenue – Operating Expenses) ÷ Available Rooms

Real-world example: A boutique hotel in Mykonos increased their RevPAR by 20% through dynamic pricing but saw their GOPPAR decrease by 8% due to higher labor costs during peak season. This metric revealed they needed to optimize staffing efficiency, not just room rates.

Industry benchmark: Luxury hotels typically achieve GOPPAR of €80-150, while mid-scale properties target €40-80.

REVPAC (Revenue Per Available Customer)

What it measures: Total revenue generated per guest, including all spending beyond room rates.

Why it matters: REVPAC shows how effectively you’re monetizing each guest relationship across all touchpoints—rooms, F&B, spa, activities, and services.

How to calculate: REVPAC = Total Revenue (all sources) ÷ Total Number of Guests

The REVPAC revelation: I worked with a family resort in Rhodes where room revenue was flat, but REVPAC increased 25% through enhanced dining experiences and activity packages. They discovered their guests were willing to spend more—they just needed the right offerings.

Optimization strategies:

- Implement strategic upselling at check-in

- Create compelling F&B experiences

- Develop packages that encourage additional spending

- Train staff to identify revenue opportunities naturally

-

- Customer Acquisition Cost (CAC)

- Direct bookings: €35-75 CAC

- Google Ads: €80-150 CAC

- OTA commissions: €60-120 CAC

- Social media: €90-200 CAC

- TRevPAR (Total Revenue Per Available Room)

What it measures: Revenue from all sources—not just room sales—divided by available rooms.

Why it matters: TRevPAR captures the complete revenue picture, including F&B, spa services, parking, business centers, and other amenities.

How to calculate: TRevPAR = (Room Revenue + Ancillary Revenue) ÷ Available Rooms

The TRevPAR advantage: A 200-room resort in Santorini with modest RevPAR of €120 achieved TRevPAR of €185 through exceptional dining, wellness services, and exclusive experiences. This metric helped them realize their true revenue potential lay beyond room sales.

- TRevPAR (Total Revenue Per Available Room)

- Hotel Retention Rate

What it measures: The percentage of guests who return within a specific timeframe.

Why it matters: Acquiring new customers costs 5-25 times more than retaining existing ones. Your retention rate directly impacts long-term profitability.

How to calculate: Retention Rate = (Returning Guests ÷ Total Unique Guests) × 100

Retention optimization:

- Personalized post-stay communications

- Exclusive offers for returning guests

- Loyalty program benefits

- Memorable experience creation

Industry benchmarks:

- Luxury hotels: 40-60% annual retention

- Business hotels: 30-45% annual retention

- Leisure resorts: 25-40% annual retention

- Hotel Retention Rate

- Revenue Per Square Meter (RevPASM)

What it measures: Revenue generated per square meter of your property.

Why it matters: RevPASM helps optimize space utilization and identify underperforming areas that could generate additional revenue.

How to calculate: RevPASM = Total Revenue ÷ Total Usable Square Meters

Space optimization insights: Transform underutilized lobbies into co-working spaces, convert storage areas into retail opportunities, or redesign restaurants for better capacity. A Athens business hotel increased RevPASM by 30% by creating flexible meeting pods in previously wasted corridor space.

- Revenue Per Square Meter (RevPASM)

- Average Length of Stay (ALOS) Impact Metrics

What it measures: How stay duration affects total guest value and operational efficiency.

Why it matters: Longer stays typically yield higher profit margins due to reduced turnover costs and increased ancillary spending.

Key calculations:

- Revenue per day of stay

- Housekeeping costs per stay vs. per night

- Ancillary spending correlation with stay length

ALOS optimization strategies:

- Stay extension incentives

- Multi-night packages with progressive benefits

- Late checkout perks for longer stays

- Activity schedules that encourage extended visits

- Average Length of Stay (ALOS) Impact Metrics

Benchmarking Against Regional Competition

Creating Your Competitive Dashboard

Step 1: Identify Your Competitive Set

- Direct competitors (same market, similar positioning)

- Aspirational competitors (properties you want to match)

- Substitute competitors (different property types serving similar guests)

Step 2: Gather Competitive Intelligence

- STR (Smith Travel Research) data for market performance

- OTA pricing and positioning analysis

- Social media engagement metrics

- Guest review sentiment analysis

Step 3: Establish Regional Benchmarks

For Greek markets, I typically see these ranges:

Athens Business Hotels:

- GOPPAR: €45-85

- TRevPAR: €95-160

- Retention Rate: 35-50%

Greek Island Resorts:

- GOPPAR: €55-120

- TRevPAR: €140-280

- Retention Rate: 25-45%

Boutique Properties:

- GOPPAR: €40-95

- TRevPAR: €110-210

- Retention Rate: 40-65%

Read also: The Impact of JOMO on the Hospitality Industry

Monthly Competitive Analysis Process

- Performance Gap Analysis: Compare your metrics against top quartile performers

- Trend Identification: Spot market-wide changes before they impact your revenue

- Strategy Adjustment: Modify pricing, marketing, or operations based on competitive insights

- Opportunity Recognition: Identify unmet market needs your property could address

Technology Tools for Automated Tracking

Revenue Management Systems (RMS)

Enterprise Solutions:

- IDeaS Revenue Solutions: Advanced forecasting and optimization

- Duetto: Real-time pricing and revenue strategy

- Atomize: AI-powered dynamic pricing

Mid-Market Options:

- RoomPriceGenie: Affordable automated pricing

- PriceLabs: Comprehensive revenue management

- SnapShot: Analytics and business intelligence

Business Intelligence Platforms

Data Visualization:

- Tableau: Complex data storytelling

- Power BI: Microsoft-integrated analytics

- Looker: Cloud-native business intelligence

Hotel-Specific Analytics:

- STR (Smith Travel Research): Industry benchmarking

- ALICE: Guest experience and revenue optimization

- Revinate: Guest data and marketing automation

Integration and Automation Tools

Property Management System (PMS) Integrations: Ensure your chosen tools integrate seamlessly with your PMS for automated data flow:

- Opera Cloud

- Cloudbeds

- Mews

- Protel

Automated Reporting Setup:

- Daily Dashboards: Key metrics updated automatically each morning

- Weekly Trend Reports: Performance comparisons with previous periods

- Monthly Competitive Analysis: Benchmark updates with market data

- Quarterly Strategic Reviews: Deep-dive analytics for planning

Making Metrics Actionable: The Strategic Framework

The Weekly Revenue Review Process

Monday Morning Metrics Meeting (30 minutes):

- Review previous week’s performance across all KPIs

- Identify top 3 improvement opportunities

- Set specific targets for the coming week

Key Questions to Ask:

- Which metric showed the biggest variance from target?

- What external factors influenced our performance?

- Where can we implement quick wins this week?

- What trends are emerging in our competitive set?

Turning Insights into Action

GOPPAR Optimization:

- Identify highest-cost operational areas

- Implement efficiency improvements

- Renegotiate vendor contracts based on volume data

- Adjust staffing models for peak efficiency

REVPAC Enhancement:

- Develop targeted upselling training programs

- Create package deals that increase spending per guest

- Optimize F&B offerings based on guest preferences

- Implement technology that facilitates additional purchases

CAC Reduction:

- Shift budget to highest-performing channels

- Improve website conversion rates

- Develop referral programs

- Enhance email marketing automation

The Future of Hotel Revenue Metrics

As the hospitality industry continues to evolve, new metrics are emerging:

Guest Lifetime Value (GLV): Total revenue expected from a guest relationship over time Environmental Impact Per Room (EIPR): Sustainability metrics that influence guest choice Digital Engagement Score: Measuring online interaction quality and its revenue correlation Experience Satisfaction Index (ESI): Linking specific experiences to revenue generation

The hotels that thrive in the coming years will be those that embrace comprehensive revenue measurement, moving far beyond the limitations of RevPAR to gain true insight into their business performance.

Remember: metrics without action are just numbers on a screen. The real value comes from using these insights to make strategic decisions that drive sustainable revenue growth and create exceptional guest experiences.

Ready to revolutionize your hotel's Revenue Strategy?

Start by implementing just one additional KPI this month. I recommend beginning with GOPPAR—it will immediately reveal whether your current revenue strategies are actually profitable. The insights might surprise you, and they’ll definitely transform how you think about your hotel’s performance.

Afroditi Arampatzi

Marketeer

Hi, I’m Afroditi!

An experienced marketer with a passion for driving impactful projects and delivering strategic solutions.

With over 15 years of hands-on experience in project management, I specialize in advertising, data analysis, strategic planning, and team leadership.